Article

Article

Rodney Sullivan, executive director of the Mayo Center of Asset Management, says an emerging AI-driven productivity boom could lift corporate margins and broaden stock market gains beyond a narrow group of technology leaders.

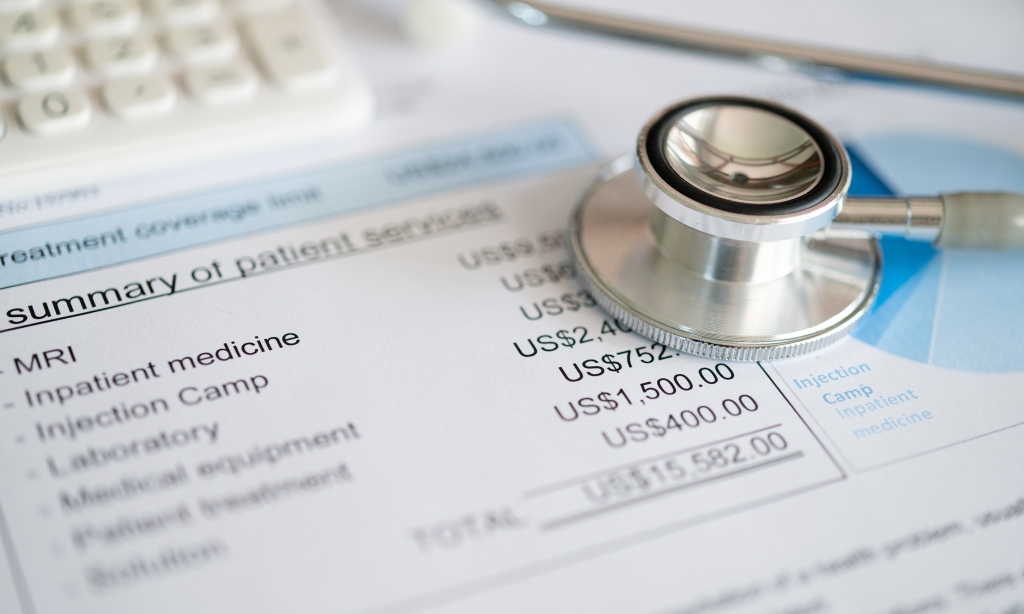

Health care fraud costs the U.S. more than $100 billion annually. Why is that? And how can technology — and specifically artificial intelligence — help us identify problems sooner and potentially help prevent billions in medical fraud and abuse?

Carried interest is once again under scrutiny in Washington. UVA Darden Professor Les Alexander explains what it is, why it's controversial and how proposed changes to its tax treatment could reshape the landscape for private equity and venture capital.

Rising healthcare costs are distorting credit scores, making some borrowers appear more creditworthy than they are. Research from the Mayo Center for Asset Management shows that unreported medical debt leads to higher loan defaults and affects access to credit. Are lenders aware of the risks? What does this mean for borrowers and policymakers?

A new business case on infamous tech company Theranos examines the risks for entrepreneurs, board members and investors in the fog of the innovation economy.

The Mayo Center's Rodney Sullivan and Matthew Wey argue that hedge funds' ability to generate alpha has changed since 2008. Once delivering outperformance of 3.7% annually on average, these investment vehicles now struggle to beat a comparable traditional portfolio, leading investors to question whether their relatively high fees remain justified.

Companies' heavy investment in artificial intelligence is driving up overall tech spending. This trend could potentially ignite a boom in worker productivity as firms harness AI's potential. Rodney Sullivan, executive director for the Mayo Center of Asset Management, discusses the significance of this development and its implications for investors.

A growing number of MBA graduates are pursuing Entrepreneurship Through Acquisition (ETA), a strategy that lets them fast-track their way to the top by buying and running small businesses. Les Alexander, professor at UVA Darden, explains why ETA is booming.

No matter how one refers to it — “ESG” (environmental, social and governance), “responsible” or “sustainable” investing — the world is paying increased attention to investment decisions that include nonfinancial factors. Research examines if investment managers invest their clients’ capital as responsibly as they pledge to.

Since 2000, the U.S. has experienced a decline in the number of publicly traded companies, a trend that comes with significant economic risks and implications. Proponents of deregulation cite increased disclosure and regulatory burdens placed on public companies as the cause. Is that indeed the case? Award-winning research examines the issue.